Opportunity knocks. Invest with us today.

Three Point Capital Corp. is a Mortgage Investment Corporation (MIC).

MICs were created to make mortgage investing easier. A MIC allows individuals to pool their funds, similar to a mutual fund, and invest those funds in a diversified portfolio of mortgage loans for Three Point Capital Corp. All Three Point Capital mortgages are secured against residential homes. A management company performs the day-to-day administration of the fund, in this case, Three Point Capital Management Corp., with over 30 years of mortgage lending experience. Each year the MIC pays 100% of net income out to its investors in the form of dividends. These dividends are currently paid monthly to investors and can be taken in cash or re-invested in new shares.

Benefits of MIC investing within a well diversified portfolio

RRSP / TFSA / RRIF / FHSA Eligible

Hold your Three Point Capital Corp. shares inside a self-directed RRSP, TFSA or RRIF.

Real Estate Security

Mortgages selected by the MIC to invest in are secured by Canadian residential homes, primarily in first position.

Professional Management

Three Point Capital Management Corp. has been a Mortgage Investment Corp. (MIC) manager for over 30 years.

Diversification & Market Downturn Protection

Investors own shares in a diversified portfolio of residential mortgages located in BC, Alberta and Ontario at loan-to-value ratios typically below 60% LTV, so when real estate markets fluctuate, the equity of the borrower/homeowner absorbs any losses above the mortgage value.

Regular Income

Dividends are treated as interest income for tax purposes in non-registered accounts.

Get to know Three Point Capital Corp.

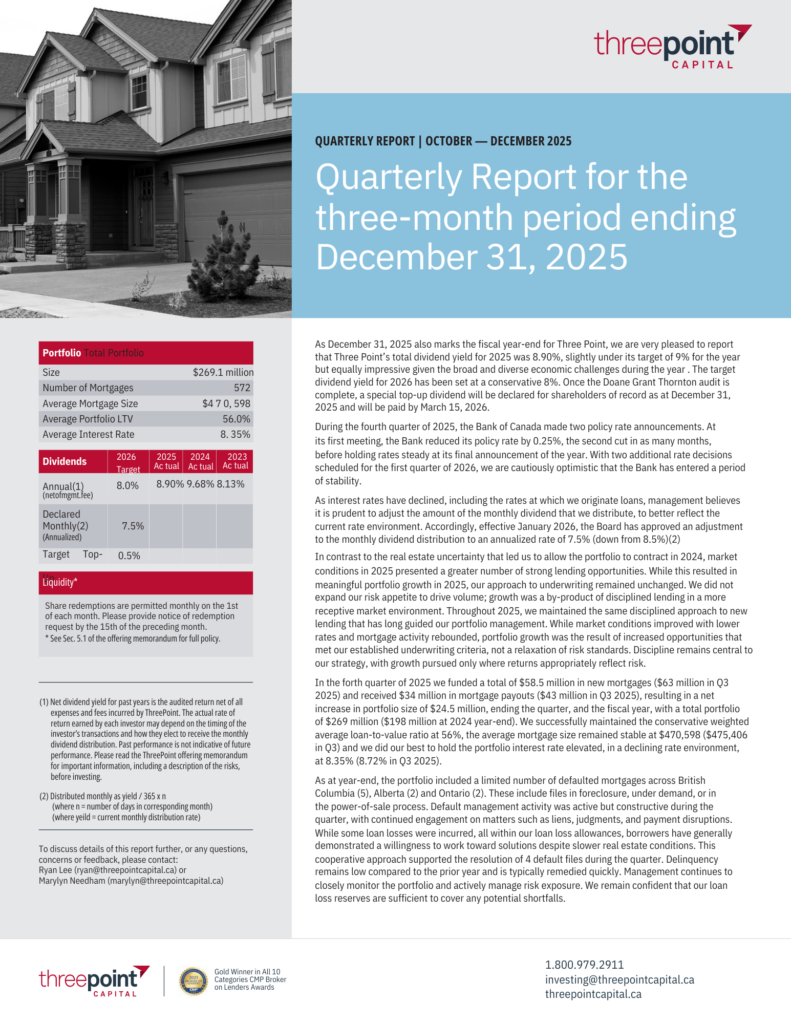

Track record

Past year audited annual returns for Three Point Capital Corp. are listed below. Past performance is not indicative of future performance, however, the company is currently distributing dividends to its shareholders each month (at a rate of 7.50% / 365 days in year x number of days in corresponding month), with the addition of a 13th top-up dividend expected to be declared annually for each shareholder of record on December 31st to ensure total dividends paid each year match the actual performance of the company.

*Annual Return (%)

2025

8.90%

2024

9.68%

2023

8.13%

2022

5.9%

2021

6.04%

2020

6.28%

2019

7.03%

2018

7.17%

2017

7.08%

*This document does not constitute an offer or solicitation to sell or purchase any securities. The securities described herein are offered on a private placement basis and available for purchase only under an offering memorandum and in those jurisdictions, and to those persons, where, and to whom, they may be lawfully offered for sale. Net dividend yield for past years is the audited return net of all expenses and fees incurred by Three Point. The actual rate of return earned by each investor may depend on the timing of the investor’s transactions and how they elect to receive the monthly dividend distribution. Past performance is not indicative of future performance. Please read the Three Point offering memorandum for important information, including a description of the risks, before investing.

Dividends

Three Point Capital Corp. dividends are currently declared and paid monthly. Three Point Capital Corp. has delivered uninterrupted monthly dividends since inception and offers the choice of monthly cash dividend payments or dividend reinvestment program (DRIP) that allows investors to automatically reinvest their dividends in new shares of Three Point Capital Corp. and enjoy the benefit of compounding interest.

The monthly dividend distributed by Three Point Capital Corp. is currently set at 7.50% per annum (calculated as 7.50% / 365 days in year x number of days in month) and is paid each month with an additional 13th “top-up” dividend paid to each shareholder of record on the last day of the fiscal year (December 31st) to match the actual yield earned by the company as confirmed by their Auditors (Doane Grant Thornton)

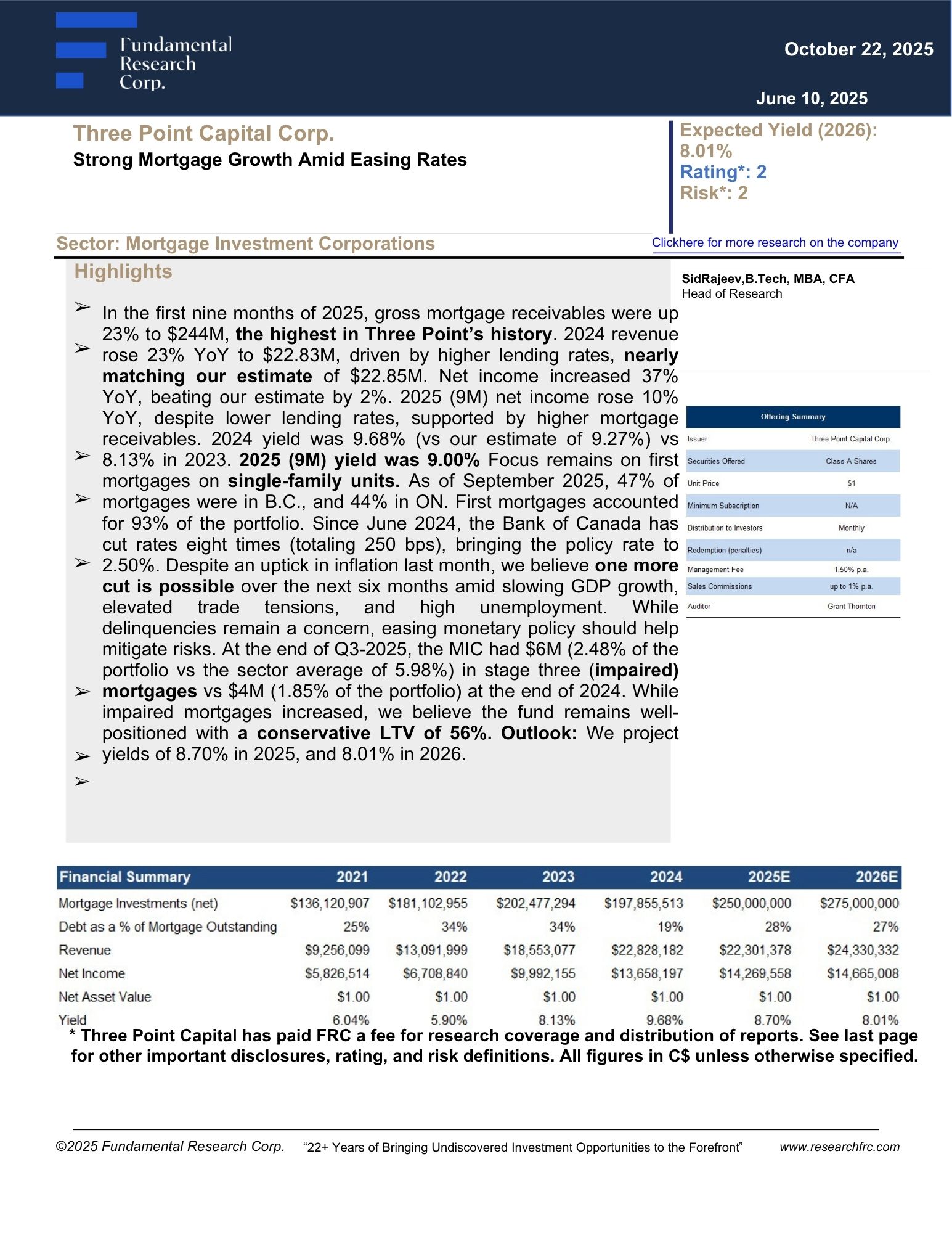

Fundamental Research Report PDF

(Analyst coverage paid for by Three Point Capital Wealth)

Corporate Video

Watch our corporate video to explore Three Point’s disciplined approach to mortgage investing, and our 30th anniversary video to learn even more about us.

Visit our YouTube channel for more content from our team.

Know the

Risks.

No investment comes without its own set of risks and features. Please take time to review the Offering Memorandum with Audited Financial Statements below. The Three Point Capital Wealth Management Relationship Disclosure Information including Conflicts of Interest document (RDI) can also be reviewed below. You are encouraged to review the RDI as it outlines how Three Point Capital Wealth Management only offers the securities of Three Point Capital Corp., a related company. As the companies are related, it is important to us that you realize we do not offer any other investment securities beyond those of Three Point Capital Corp. The RDI document will fully explain this relationship.

How to Invest in Three Point Capital

For BC and AB clients, you can work with related party Exempt Market Dealer (EMD) Three Point Capital Wealth Management Inc., which is an EMD owned and operated by a related entity to the Three Point Capital MIC investment. This connected Issuer and Dealer relationship does present a number of unique conflicts of interest. To read Three Point Capital Wealth Management’s full Relationship Disclosure Information including Conflicts of Interest document (RDI), please view the PDF. If you would like to meet with a Dealing Representative from Three Point Capital Wealth Management to discuss both eligibility and suitability, please contact us.

Ryan Lee, UDP, Dealing Representative – Three Point Capital Wealth Management Inc.

Marylyn Needham, Chief Compliance Officer, Dealing Representative -Three Point Capital Wealth Management Inc.

Danica Trentalance, Dealing Representative – Three Point Capital Wealth Management Inc.