Empowering mortgage brokers through our innovative and flexible lending solutions.

Lending Guidelines, Rates & Locations

As your trusted partner in the mortgage industry, Three Point Capital understands the importance of providing residential mortgage solutions that anticipate a borrower’s needs. Our experienced underwriting team is ready to assist you with rates and terms that have been crafted to ensure your clients have access to flexible financing solutions tailored to their unique circumstances.

Here are some key highlights on our flexible lending solutions, guiding you on the path to informed decisions.

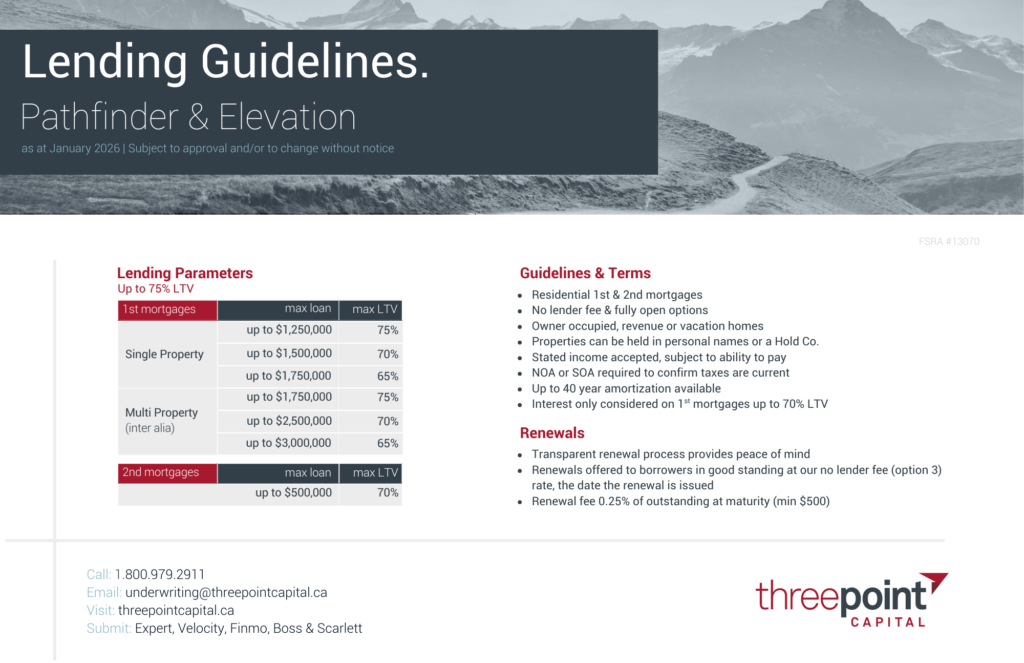

- Pathfinder: No Fee or Lower Rate

- Elevation: 3% Split Fee (50% lender & 50% brokerage finders fee)

- Residential 1st and 2nd mortgages

- Up to 75% LTV

- Flexible 1 year terms

- Fully open options

- Interest only or amortized payments

- Efficient funding process

- Transparent renewal process

Blaze your own trail with Pathfinder & Elevation!

Subject to approval and/or change without notice.

Underwriting Team: underwriting@threepointcapital.ca | 800.979.2911

Loren Hawkins, Director Broker Relations – Western Canada: loren@threepointcapital.ca | 778.215.2056

Justin Theriault, Director Broker Relations – Eastern Canada: justin@threepointcapital.ca | 437.422.7572

Lending Locations

Three Point Capital provides reliable and flexible financial solutions across marketable real estate communities within British Columbia, Alberta and Ontario. Whether your clients are seasoned investors or first-time homebuyers, our solutions are designed to meet the diverse needs of the urban market across all of our approved lending areas.

To discover more about our specific lending areas, please view our current lending location guides for British Columbia, Alberta and Ontario below. Our underwriting team is also always happy to discuss any location requests in more detail.

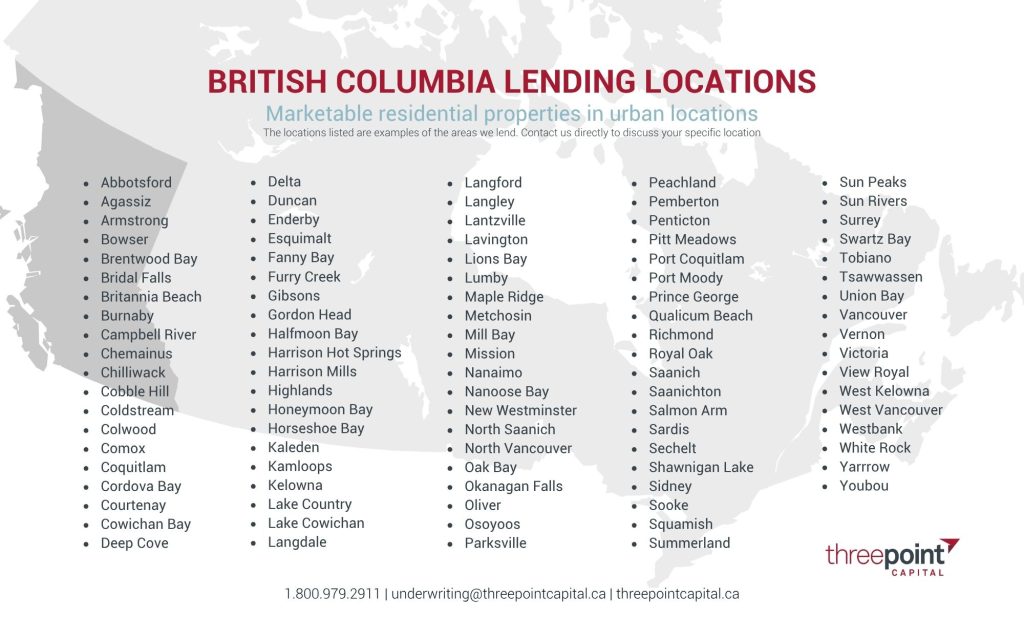

BC Lending Locations

Marketable residential properties in urban locations

- Abbotsford

- Agassiz

- Armstrong

- Bowser

- Brentwood Bay

- Bridal Falls

- Britannia Beach

- Burnaby

- Campbell River

- Chemainus

- Chilliwack

- Cobble Hill

- Coldstream

- Colwood

- Comox

- Coquitlam

- Cordova Bay

- Courtenay

- Cowichan Bay

- Deep Cove

- Delta

- Duncan

- Enderby

- Esquimalt

- Fanny Bay

- Furry Creek

- Gibsons

- Gordon Head

- Halfmoon Bay

- Harrison Hot Sprg

- Harrison Mills

- Highlands

- Honeymoon Bay

- Horseshoe Bay

- Kaleden

- Kamloops

- Kelowna

- Lake Country

- Lake Cowichan

- Langdale

- Langford

- Langley

- Lantzville

- Lavington

- Lions Bay

- Lumby

- Maple Ridge

- Metchosin

- Mill Bay

- Mission

- Nanaimo

- Nanoose Bay

- New Westminster

- North Saanich

- North Vancouver

- Oak Bay

- Okanagan Falls

- Oliver

- Osoyoos

- Parksville

- Peachland

- Pemberton

- Penticton

- Pitt Meadows

- Port Coquitlam

- Port Moody

- Prince George

- Qualicum Beach

- Richmond

- Royal Oak

- Saanich

- Saanichton

- Salmon Arm

- Sardis

- Sechelt

- Shawnigan Lake

- Sidney

- Sooke

- Squamish

- Summerland

- Sun Peaks

- Sun Rivers

- Surrey

- Swartz Bay

- Tobiano

- Tsawwassen

- Union Bay

- Vancouver

- Vernon

- Victoria

- View Royal

- West Kelowna

- West Vancouver

- Westbank

- White Rock

- Yarrrow

- Youbou

The locations listed are examples of the areas lend in. Contact us directly to discuss your specific location.

Alberta Lending Locations

Marketable residential properties in urban locations

- Airdrie

- Balzac

- Beaumont

- Blackfalds

- Bowden

- Calgary

- Camrose

- Canmore

- Carstairs

- Chestermere

- Cochrane

- Devon

- Didsbury

- Drayton Valley

- Drumheller

- Edmonton

- Fort MacLeod

- Fort Sask.

- Grande Prairie

- High River

- Innisfail

- Lacombe

- Leduc

- Lethbridge

- Morinville

- Medicine Hat

- Nisku

- Okotoks

- Olds

- Penhold

- Redcliff

- Red Deer

- Sherwood Park

- Spruce Grove

- St. Albert

- Stony Plain

- Strathmore

- Sylvan Lake

- Villeneuve

- Whitecourt

The locations listed are examples of the areas lend in. Contact us directly to discuss your specific location.

Ontario Lending Locations

Marketable residential properties in urban locations

- Ajax

- Aurora

- Barrie

- Belleville

- Bowmanville

- Brampton

- Burlington

- Cambridge

- Carleton Place

- Chatham-Kent

- Cobourg

- Collingwood

- Cornwall

- Essex

- Etobicoke

- Georgetown

- Georgina

- Gravenhurst

- Grimsby

- Guelph

- Hamilton

- Innisfill

- Kanata

- Keswick

- Kingston

- Kitchener

- Leamington

- London

- Markham

- Meaford

- Milton

- Mississauga

- Napanee

- Nepean

- Newmarket

- Niagara Falls

- North Bay

- Oakville

- Orangeville

- Orillia

- Oshawa

- Ottawa

- Owen Sound

- Petawawa

- Peterborough

- Pickering

- Port Colbourne

- Prince Edward

- Richmond Hill

- Sarnia

- Scarborough

- Simcoe

- St. Catharines

- Stratford

- Sudbury

- Tavistock

- Thornbury

- Thorold

- Thunder Bay

- Tilbury

- Tweed

- Vaughan

- Walkerton

- Wasaga Beach

- Waterloo

- Welland

- Whitby

- Windsor

- Woodstock

- York Region

The locations listed are examples of the areas lend in. Contact us directly to discuss your specific location.

“Three Point Capital is an exceptional lending partner that consistently delivers top-notch service throughout every stage of the mortgage process. Loren and his team always provide clear and consistent communication ensuring smooth transactions for my clients. Their underwriting team demonstrates a rare blend of expertise and common sense, creating solutions for our clients who don’t fit the traditional lending criteria. I highly recommend Three Point Capital to anyone seeking a reliable partner in alternative financing.”

Evangeline Thasitis, Mortgage Broker

TMG The Mortgage Group, Edmonton, AB

Broker Newsletter Sign-Up

Sign up for our newsletter to receive exclusive updates from our team including details on our latest products, rates & guidelines.

By entering your name and email address, you consent to Three Point Capital Corp. sending you email newsletters and updates. You may unsubscribe at any time from receiving these communications by clicking on the unsubscribe link that is included at the bottom of each communication.