ABOUT US

OUR BUSINESS

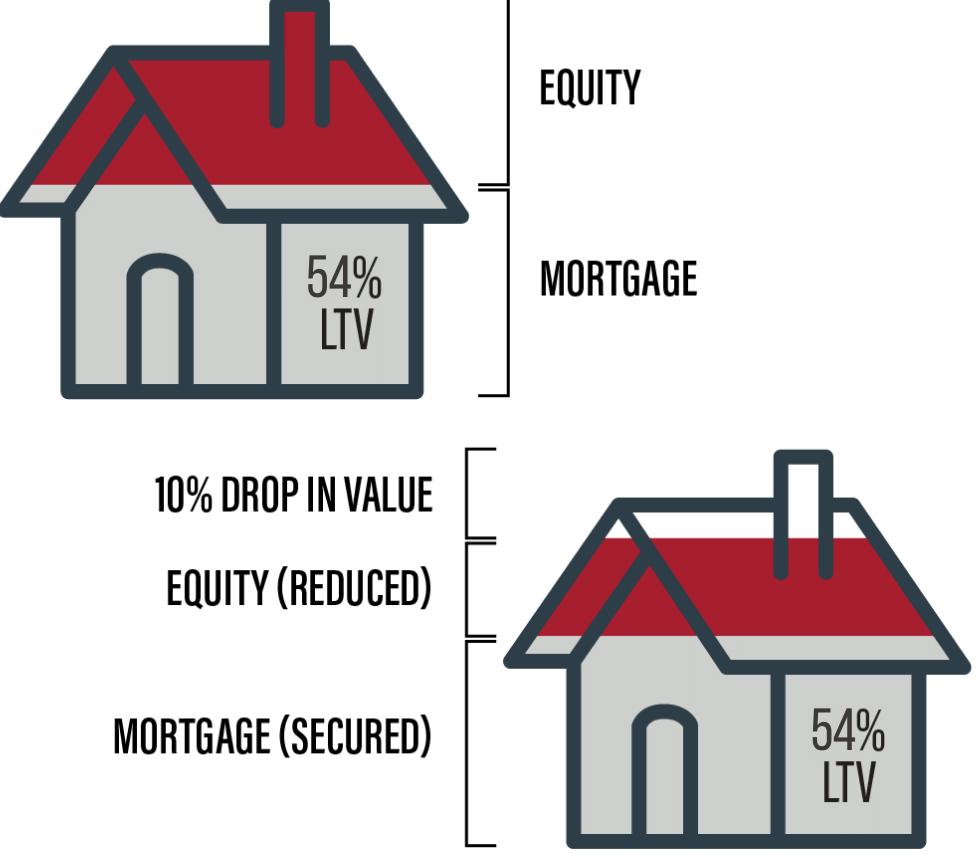

Investing in real estate offers security, but owning it can be risky when markets soften. MIC investing offers downside protection relative to an equity investment when real estate values decline. We lend, on average, 55% – 65% of the value of a home, so our portfolio can absorb a drop in the housing market with minimal expectation of loss to the portfolio as a whole.

We provide mortgages to borrowers whose financing needs are not being met by larger financial institutions. The average size of mortgage in our portfolio as of December 31, 2023 is $428,388 with a weighted average interest rate of 10.11% and a portfolio average loan-to-value of 54.5%. The loan-to-value ratio of any mortgage at the time of underwriting may not exceed 75% of the current appraised value.

We consider our mortgage portfolio high quality yet we are able to charge higher rates than the banks because we offer flexibility, short term solutions and we serve a segment of the market that is currently under-served.

A typical loan in our portfolio has an interest rate of 9% to 10% per annum, a loan-to-value ratio of 55% – 65%, a one-year term and monthly amortized mortgage payments.

OUR PORTFOLIO

(At December 31st, 2023)